Private Trust

While paying attention to the preservation, appreciation and global allocation of assets,HNWIs are also concerned about their tax arrangement and succession planning. There is a high demand for customized solutions to cater for individual wealth succession and asset protection needs. SWCS can tailor the best fit wealth succession plan and trust structure to meet our clients’ objectives and requirements.

SWCS Trustee Service

1. Family Trust

2. Insurance Trust

3. Private Trust Company

4. Family Office

What is a Trust?

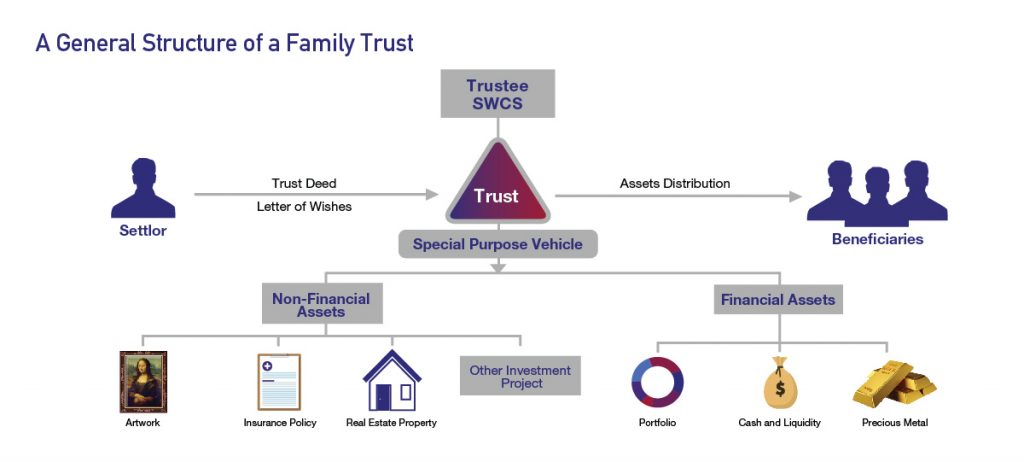

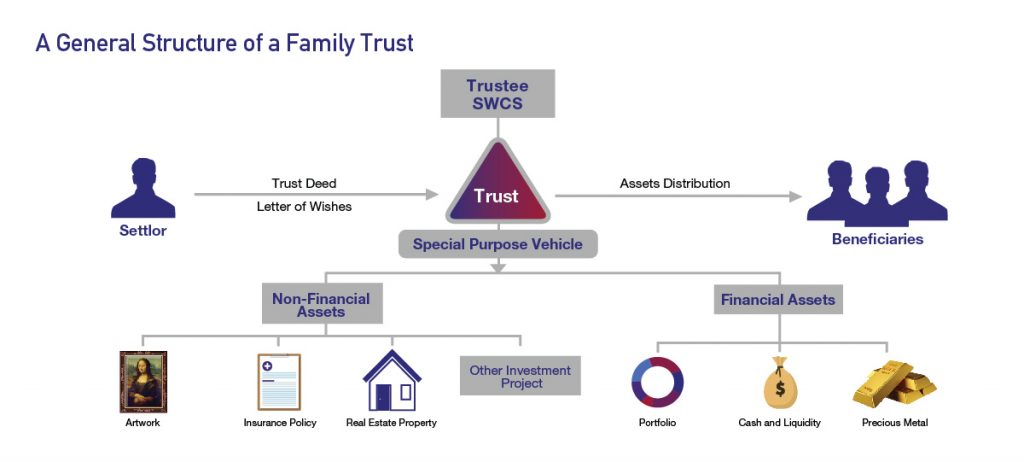

Originating in England, the trust concept and principles generally apply to common law jurisdictions and international conventions, now allowing its recognition in some civil law countries. Trust is a legal relationship usually created by a deed, together with a letter of wishes (Trust Documents), where an individual (Settlor) transfers assets (Trust Assets) to another individual or a trust company (Trustee) for the benefit of a third party (Beneficiary). As soon as the trust relationship is formed, the Settlor loses ownership of the Trust Assets and the ownership is then split between the Trustee as legal owner and the Beneficiary as equitable interest owner.

Advantages of Trust

Asset Protection:

Upon the setup of a trust, the legal titles of the assets are transferred from the settlor to the trustee. If the settlor is the subject of any claims due to loan or guarantee, the trust asset will not be exposed to claims from the creditors.

Confidentiality:

The trustee cannot disclose information about the trust.

Inheritance of Wealth: Unlike estate, assets in a trust do not have to go through any probate process. Settlors can create their own inheritance rules which effectively protect family wealth from possible squandering, divorce risk and excessive debt from their heirs.

Tax Planning:

Proper tax planning can effectively mitigate the overall tax liability of the family assets by optimizing the asset structure or via deferral of tax payment.

Investment Planning:

Trustees can appoint professional investment agents or asset managers to manage and structure investment plans to enhance the value of their trust assets.

Orderly Distribution of Assets:

The trustee manages the assets according to the wishes of the settlor who can set up reference terms and restrictions on the investment of these assets and their distribution to beneficiaries.

Benefits Of Trust

Transfer of Personal Assets

Personal assets managed by a professional trustee

Mitigate risks from personal assets

The separate risk from business and increase the level of asset protection

Safe Transferring of Assets (Estate and Succession Planning)

A clear designation of beneficiaries

Avoidance of complex legal procedures and high cost on probate

Enable successors to inherit the assets or businesses smoothly

High Level of Confidentiality and Protection

Long-standing history of trust services and trust jurisdictions

Ensure the safety of heritage assets

Protect assets against the impact on potential liabilities

Our areas of expertise

- Discretionary Trust

- Fixed Interest Trust

- Reserved Power Trust

- Standby Trust

- Private Trust Company

- Foundation

Why SWCS?

- Well experienced professional trust and compliance team with international and local certifications

- Customized and effective solutions according to types of assets

- Thorough analysis of possible tax exposure associated with your assets

- Integrated and one-stop services from corporate trust to individual wealth succession

Employee Stock Ownership Plan (“ESOP”)

Assisting you to attract, retain and motivate your talents, propelling your business forward