Corporate Sustainability, Climate Change and Environmental, Social & Governance (ESG) Reporting And Advisory

Environmental, Social and Governance (“ESG”) is no longer merely a corporate social responsibility or a reputational issue. It affects businesses, and failure to manage these risks carefully may bring about real financial impacts on the company. According to the Main Board Listing Rules and the GEM Listing Rules of the Stock Exchange of Hong Kong Limited (“HKEX”), listed companies have to meet the requirements of the Environmental, Social and Governance Reporting Guide (the “Guide”) and required to publicly disclose an ESG report on an annual basis, regarding the same period covered in their annual report.

The new requirements on the ESG Reporting Guide (“ESG Guide”) and related Listing Rules by the Stock Exchange of Hong Kong Limited (“the Exchange”) will come into effect for financial years commencing on or after 1 July 2020, and mandatory disclosure requirements are added as disclosure obligation. Besides, the Exchange has updated guidance letter HKEX-GL86-16 for IPO applicants (IPO Guidance) in July 2020, which highlights the importance to an IPO applicant’s Board of ensuring that the necessary corporate governance and ESG mechanisms are built into the listing processes, and requires disclosures in ESG issues and significant ESG risks in the prospectus.

Mandatory disclosure requirements (MDR)

- Board governance structure

- Application of reporting principles

- Reporting boundary

New/Amendment “Comply or explain” provision

- New Environmental Aspect (A4 – Climate Change)

- Target setting on Environmental KPIs, describe the target(s) set and steps taken to achieve them

- Emissions; Hazardous and non-hazardous waste; Energy and Water

- Disclose Scope 1 and Scope 2 GHG emissions

- Upgrade all “social” key performance indicators to “Comply or explain”

- Enhance the disclosure of the Social KPIs.

- Employment; Health and safety; Supply chain management and Anti-corruption

Other amendments

- Shorten the timeframe for issuing ESG reports

- Encourage independent assurance

Our Services

SWCS has established a dedicated team of sustainability, climate change, ESG, and risk management specialists, which provides ESG reporting services, Corporate sustainability, ESG advisory related services of pre-IPO and IPO processes, and other sustainability consultancy services to clients in Hong Kong, China, and the Asia region.

Our ESG Reporting and Consultancy Services include:

- ESG Reporting and Advisory Services

- ESG Retain Services

- Sustainable Advisory Services

Our services

SWCS has established a dedicated team of sustainability, climate change, ESG, and risk management specialists, which provides ESG reporting services, Corporate sustainability, ESG advisory related services of pre-IPO and IPO processes, and other sustainability consultancy services to clients in Hong Kong, China, and the Asia region.

ESG Reporting

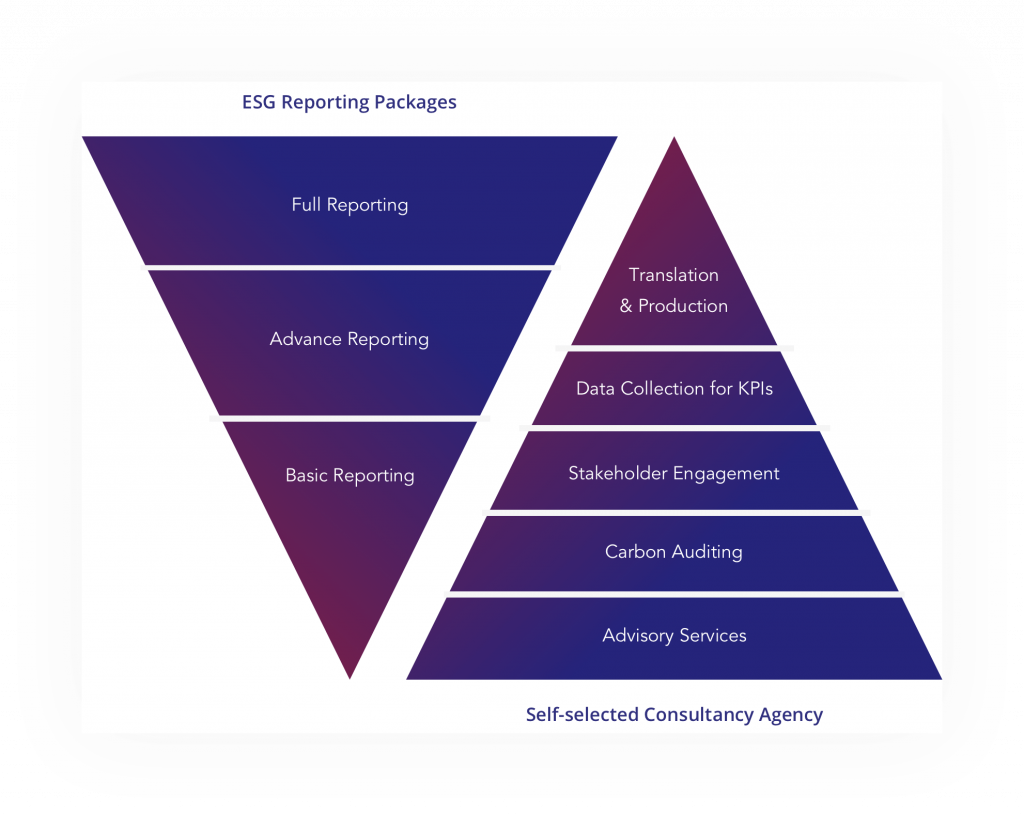

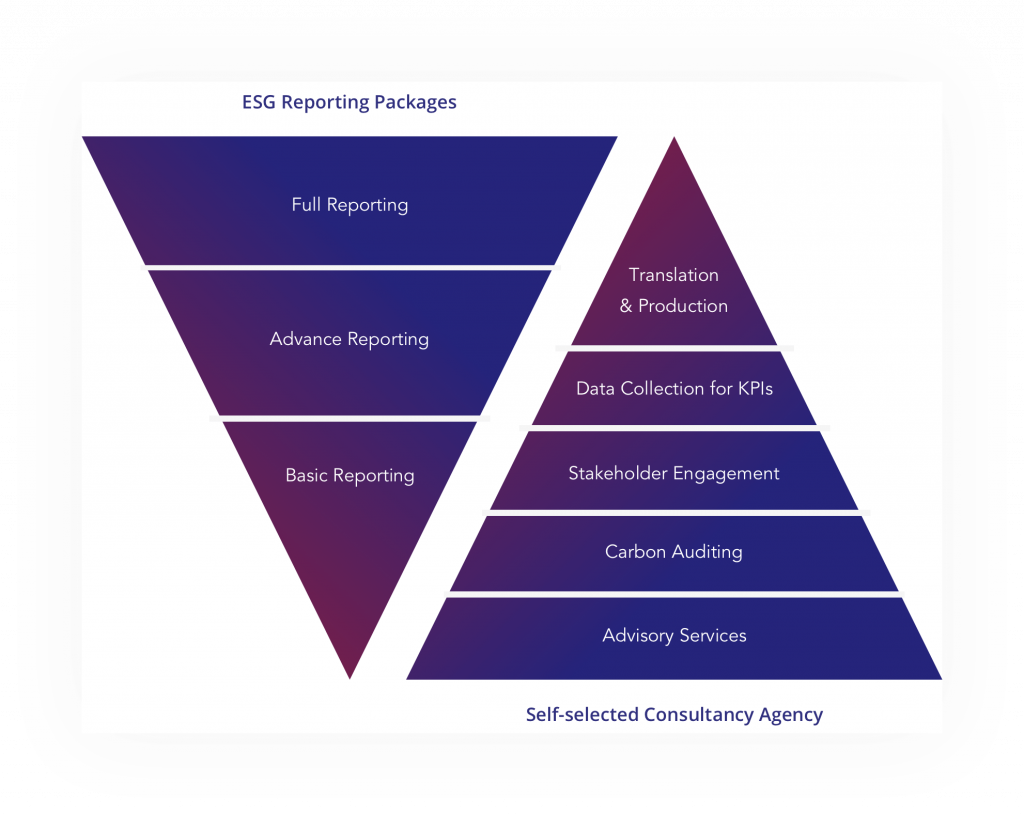

Our Basic Reporting, Advance Reporting and Full Reporting Services allow you comply with the latest ESG guide published by HKEX through providing customized data collection templates, training for senior management and staff as well as drafting a quantitative and qualitative ESG report.

Advisory Services

We offer comprehensive advisory service and guidance on establishing sustainability strategies which can assist clients in reducing operational cost and maximizing competitive advantages. For example, we provide mitigation measures on addressing environmental and social impacts by establishing the ESG data inventory, setting reduction targets, offering training to management and employees to enhance internal awareness and transparency.

Carbon Auditing

Our professional team conducts carbon audits and helps clients establish a Greenhouse Gas (GHG) inventory which allows them to understand their carbon performance. With the measurement and the analysis of carbon emissions, we advise our clients on strategies on enhancing energy efficiency and reducing carbon emissions. It enables clients to comply with the disclosure requirements of A1.1 (types of emissions), A1.2 (GHG emissions in total and GHG intensity) and A1.5 (measures to mitigate emissions and results achieved) of the ESG Reporting Guide of the HKEX.

Stakeholder Engagement

We assist our clients in engaging their internal (e.g. employees) and external stakeholders (e.g. listed issuers, shareholders, investors) in decisions-making processes through meetings, questionnaires and workshops so as to align the business practices and ESG reporting with public needs and expectations.

Data Collection for Key Performance Indicators (KPIs)

Apart from ESG reporting, we assist our clients in measuring and calculating environmental and social KPIs with reference to the ESG guide, including the information of Greenhouse gas (GHG) emissions in total, GHG intensity and the amount of hazardous and non-hazardous wastes.

Translation, Design and Typesetting

We offer one-stop services from translating, typesetting, report design to printing in order to make sure that the report reflects the ESG information to your stakeholders effectively.

Directors’ & Officers’ Training

Keeping you abreast of the global development of corporate governance