Finding a Rewarding Biotech Stock

Pre-revenue biotech companies in general tend to be high risk and lack the usual metrics of revenue or profit that investors use as yardsticks for valuation.

What happened at the backend – Sometimes it’s not all clear

Biotech is more susceptible to insider trading and more prone to market manipulation. A typical timeframe for a new drug can span for years, the process follows structured phases (pre-clinical and clinical) of research, testing, and patent review, during which the drug can fail and the failure is usually irreversible. That represents a different risk profile from most other businesses. The high risk associated with trials, patent approvals and potential casualty will directly impact the valuation of the company implying regular disclosure is crucial to keep investors updated and to mitigate the risk of market manipulation by insider information.

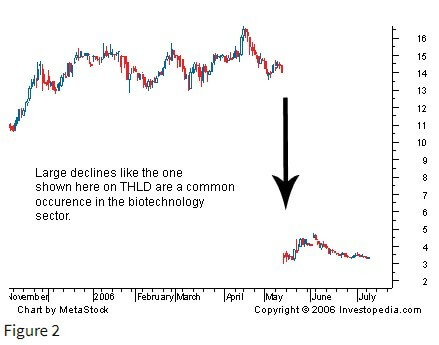

Along with the opportunity to make huge gains comes the potential for some very devastating losses. News releases about their clinical trials and/or concerning approval from the authorities can be the main factors deciding the direction of the company’s stock.

Investors have to do a lot of homework to figure out exactly what the product is, what the company’s strategic advances are and what risks are involved in the event that the product does not work. Perhaps experts with doctorates in biology understand the science behind the products, but for the average analyst, even understanding the product can be difficult. Hence, to better communicate with the investors and the public, it is essential to establish adequate corporate governance, introduce comprehensive training for the board and management, and maintain a high level of transparency.

The Masterminds Behind the Scene – Good Corporate Governance

Biotech companies are in constant need of right directors.. Who are selling on the board can make the difference to investors in their judgement in the company as well as investment decisions. Investors may probably divest their holdings if they discern a lapse in corporate governance with the concomitant adverse impact on the stock price.

While the board and the CEO work closely together, they have distinct roles to play — the board answers to the shareholders and is responsible for setting the direction of the company and for issues of corporate governance and strategic risk, while the CEO is responsible for the vision and the strategy of the company particularly R&D investments, and holds the responsibility of making sure the company meets its goals in a financially appropriate manner. When investors, analysts or the media have questions, the CEO is the person who is answerable.

Knowledge is Power – Board Training

Corporate director training programs are important components to foster board effectiveness. Regarding biotech companies in Asia, many directors are used to be professionally qualified people with accounting and legal background but lacking knowledge or experience in the niche area of the industry limits their contribution to the organization; As far as board composition goes and the prescence of this gap, the organization should carefully consider the specific skill sets required to complement the board members via diversity and board training and induction, especially for the biotech industry.

Ongoing director education is important as it provides opportunities for directors to stay current with company business strategies, prepare for emerging issues, and look ahead at “leading practices.” As biotech continues to evolve, the knowledge and skills of a director must evolve as well.

Still Confused? - Transparency and Disclosure

Having knowledge but lacking the power to express it clearly is no better than never having any ideas at all.

Calls for greater transparency in the healthcare sector have increased in recent years. Due to a long-term nature of R&D projects carried out by biotech companies, the tangible and intangible effects of R&D initiatives only become visible at the end of the project. Therefore, biotech companies should disclose qualitative R&D information regularly in order to inform their stakeholders on what have actually happened in particular milestone progress in the reported year. Patent planning is also particularly important, in order to minimize litigation risks and uncertainties and to protect the value of upside.

Ultimately, whether a company is just launching itself on the stock exchange or is a listed issuer, what it comes down to is a need for clear communication with the shareholders on matters including the use of proceeds, investment plans, working capital, accounting treatment as well as patent planning. These information should be made accessible to the shareholders in quarterly, interim and annual reports of the company, in order to prevent potential business risks.

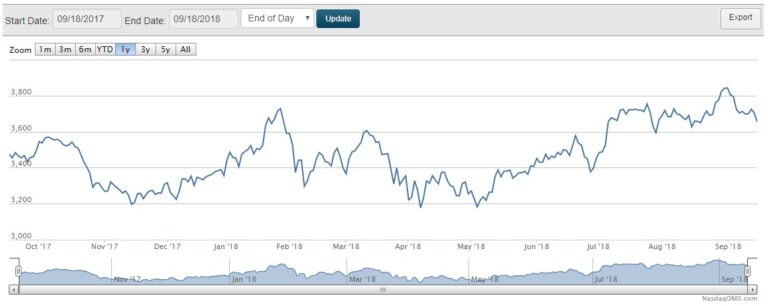

Also, biotech pipeline valuation is different. Drug development is expensive and many biotech firms do not yet have revenues. Cash flows prior to approval of a drug will highly be negative, which means standard valuation multiples are irrelevant. Even for more established biotech companies, their historical revenues are typically idiosyncratic enough that estimates still have to be built up from scratch rather than relying on company specific experience/past data or even from other, comparable companies as guide rails for projections. Nevertheless, the general market valuation trend of the biotech industry is positively appraised. This reiterates the need to establish a strong board of directors with the right set of expertise and knowledge for the biotech industry to win the vote of investors’ confidence. Investment will only thrive on transparency.

Finding a Rewarding Biotech Stock

Finding a Rewarding Biotech Stock Pre-revenue biotech companies in general tend to be high risk and lack the usual metrics of revenue or profit that investors use as yardsticks for valuation. What happened at the backend – Sometimes it’s not all clear Biotech is more susceptible to insider trading and more prone to market manipulation….

Unicorn Listing: A Confidence Game

Unicorn Listing: A Confidence Game Since the launch of Dual Class Shares (DCS), different opinions h…

Most Reliable Corporate Services of the Year Award

SWCS proudly receives Most Reliable Corporate Services Of The Year Award 2019 from HKMOS.